Client

Multiple State Departments of Labor

AGENCY

U.S. Digital Response

Role

Senior Digital Product Designer

COVID-19 caused unprecedented economic hardship in America. In response, the federal government created new unemployment insurance programs to provide alternate income for people who are out of work or working reduced hours due to COVID-19. However, states are using outdated technology that makes it extremely difficult to implement these new programs. As a result, fraudulent claims have cost the U.S. hundreds of millions of dollars, claims are taking too long to be processed, states are overwhelmed, and millions of Americans aren’t receiving benefits when they need them–or at all.

Visit usdigitalresponse.org ⟶

Overview

U.S. Digital Response helps governments and non-profits deliver responsive, people-centered services with experienced technologists. We assembled a team of seasoned strategy, research, design, and engineering volunteers who had experience working with the government and building complex digital experiences.

My role

Researched the current state of the unemployment insurance system: who the key users were, their needs and pain points, workflows, and workarounds.

Provided recommendations to improve unemployment insurance operations and staff experience, as well as the claimant experience.

Designed a claim management app prototype to show state governments the benefits of investing in automated workflows and human-centered digital experiences.

Co-authored a white paper on identity proofing to nudge unemployment insurance agencies towards automation and assist in procuring the right vendor.

Research

My research objectives were to learn about the unemployment insurance system, its major pitfalls, and the pandemic’s impact on it. We interviewed stakeholders from multiple state unemployment insurance agencies and conducted literature reviews of published research reports and news articles.

Problems with the unemployment insurance system

Before the pandemic, the unemployment insurance system had many problems that would set it up for failure in 2020:

Many state claim management systems were running on outdated, inflexible, broken technology.

Program Representatives were working with applications that offered poor user experiences, which often forced them to manually process claims and create their own workarounds to get things done.

States mistakenly overpay benefits every year due to non-fraudulent causes, like human error.

The U.S. has lost billions of dollars due to fraudulent claims.

Once the pandemic began, the aforementioned problems were amplified and new ones were introduced:

Unemployment rates dropped, and the number of new claims skyrocketed.

The federal government create five new unemployment insurance programs, but states struggled to implement them.

State unemployment insurance agencies were overwhelmed and technology was outdated, so they were unable to scale.

There were claim processing and benefit payout delays, causing millions of Americans went for months without income and financial security.

COVID-19’s impact on the system

Record unemployment rates

COVID-19 forced Americans to stay home, close businesses, and lose all or part of their income. In April 2020, the unemployment rate in the U.S. reached 14.7 % – the highest it’s been since the Great Depression in 1933.

New unemployment insurance programs

Five new programs were introduced in response to COVID-19, bringing the total number of programs to 17. These programs were created through the CARES Act and an August 8th Presidential Memorandum.

New claims skyrocketed

The unemployment rate increased from 3.6% in April 2019 to 14.7% in April 2020. More than 40 million workers have filed for unemployment insurance since March — over seven times the number of requests in all of 2019. A large backlog of claims was still waiting to be processed and paid out, as of June 2020.

Large scale unemployment fraud

Between March 2020 and January 2021, the U.S. lost more than $36 billion in unemployment benefits mostly due to fraud. It mainly came from the Pandemic Unemployment Assistance program, made vulnerable by the widespread use of identity theft.

States were overwhelmed

States are understaffed, there’s a huge influx of new claims and weekly certifications staff has to keep up with, technology is outdated and not equipped to handle new unemployment insurance programs (or custom logic).

Half of claims required manual intervention

The top five issues* that cause claims to require manual intervention (which slow down claim processing, adjudication, and benefits payouts) are Federal Pandemic Unemployment Compensation (FPUC), fraud, wage verification, claimed wages in another state (CWOS), work separation, and monetary claim. *Source: Data from one state in an anonymized study.

People and tasks

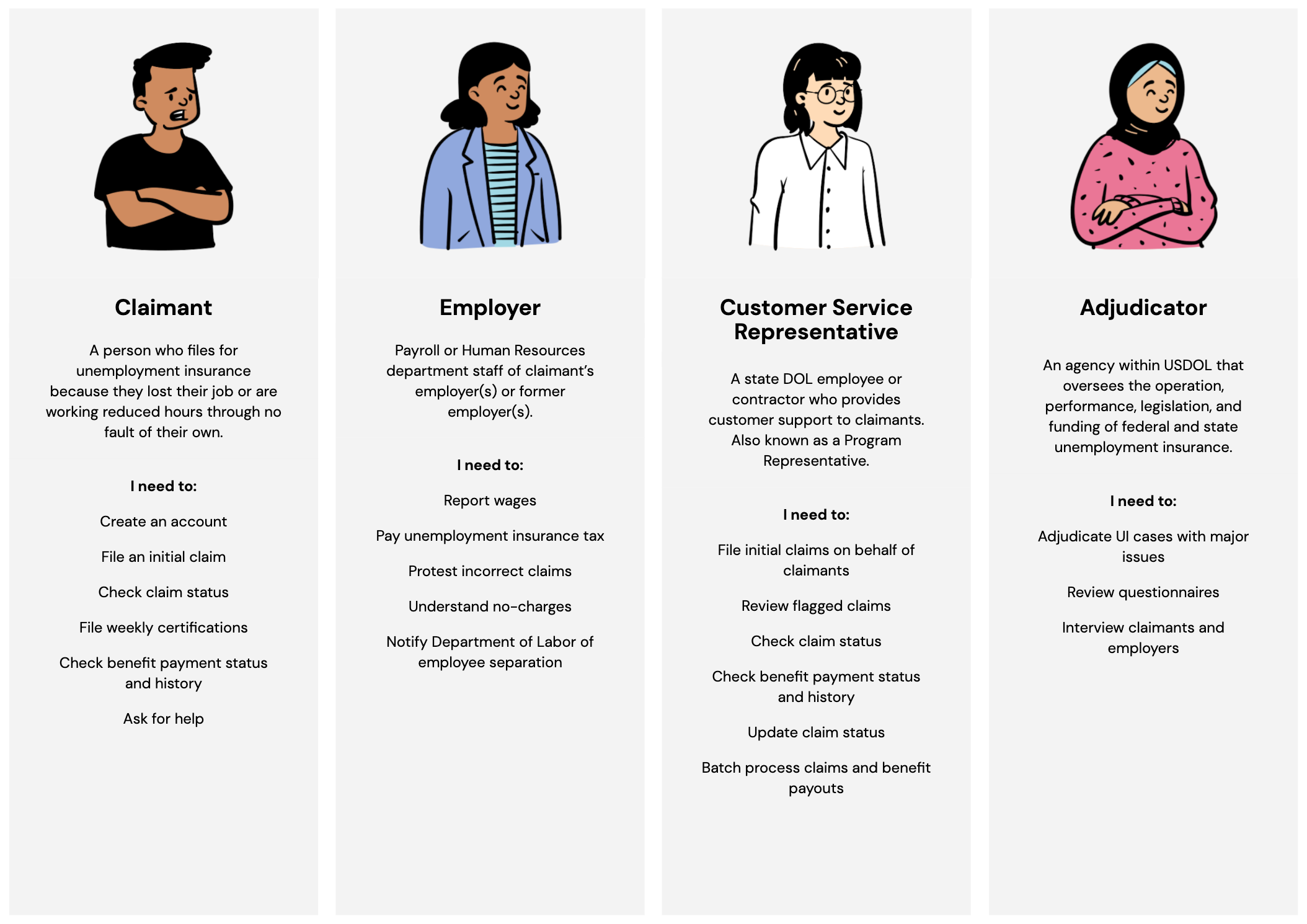

Key people

We decided to focus on claimants, employers, customer service representatives, and adjudicators because these are the people who are involved in most of the core operations of claim processing.

Supporting roles

Job Services are customer-facing but aren’t involved in filing claims or adjudication (the focal point of our research).

Field office supervisors, state unemployment insurance program leadership, and the USDOL Employment & Training Administration are groups of people who work behind the scenes and aren’t often customer-facing.

Hypotheses

While new unemployment insurance programs brought financial relief to Americans, the implementation of these programs on such a large scale caused a strain on the system. We knew we had to focus on two key areas:

Claim management workflow

Need a flexible and robust claim management system so that as new programs are introduced and existing programs change, states can continue to provide uninterrupted service and payout benefits as quickly as possible.

Need to automate data collection (e.g. wage and employer data) and processing, the claim adjudication process, and fraud investigation.

By providing clear guidance and actions throughout the claim adjudication lifecycle, adjudicators will be able to quickly complete tasks and resolve claim issues.

By allowing states to configure custom UI logic, they can quickly and successfully implement new programs and requirements.

By automating fraud investigation, states can accurately and quickly distinguish between real claims and fraudulent ones.

The claimant experience

Need straightforward and uncomplicated language for claimants to understand what programs they are eligible for and calculate the benefits they can receive.

Need a simple and intuitive filing experience, as well as a transparent way to check their claim status.

Need a proactive strategy to remind and encourage claimants to file weekly certifications and complete other important actions.

By allowing Americans to determine which UI programs and benefits they are eligible for, they will feel less overwhelmed and more supported during a crisis.

By making the claim filing process user-friendly and data-driven, Americans will be able to complete filing sooner and successfully.

Design

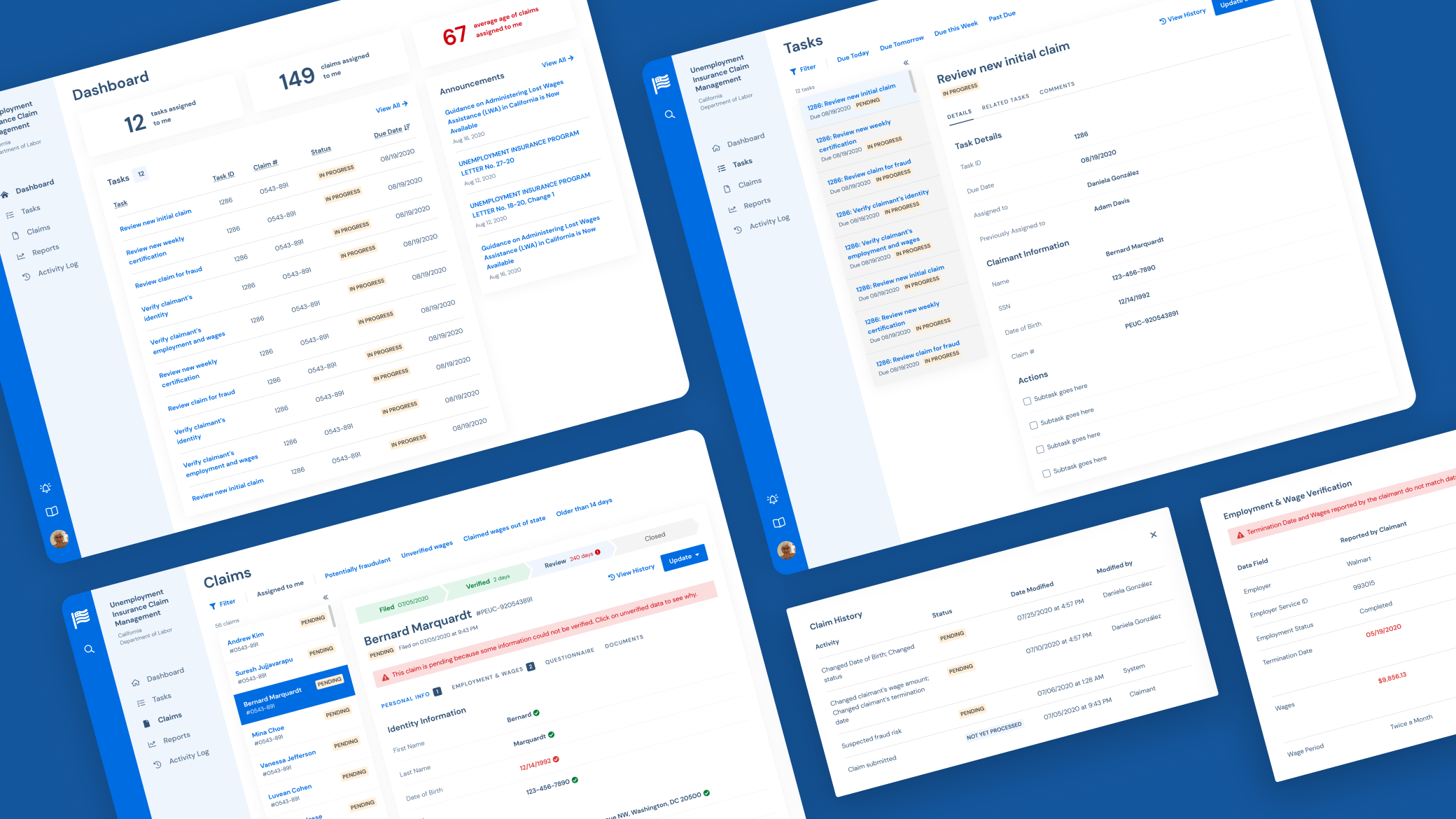

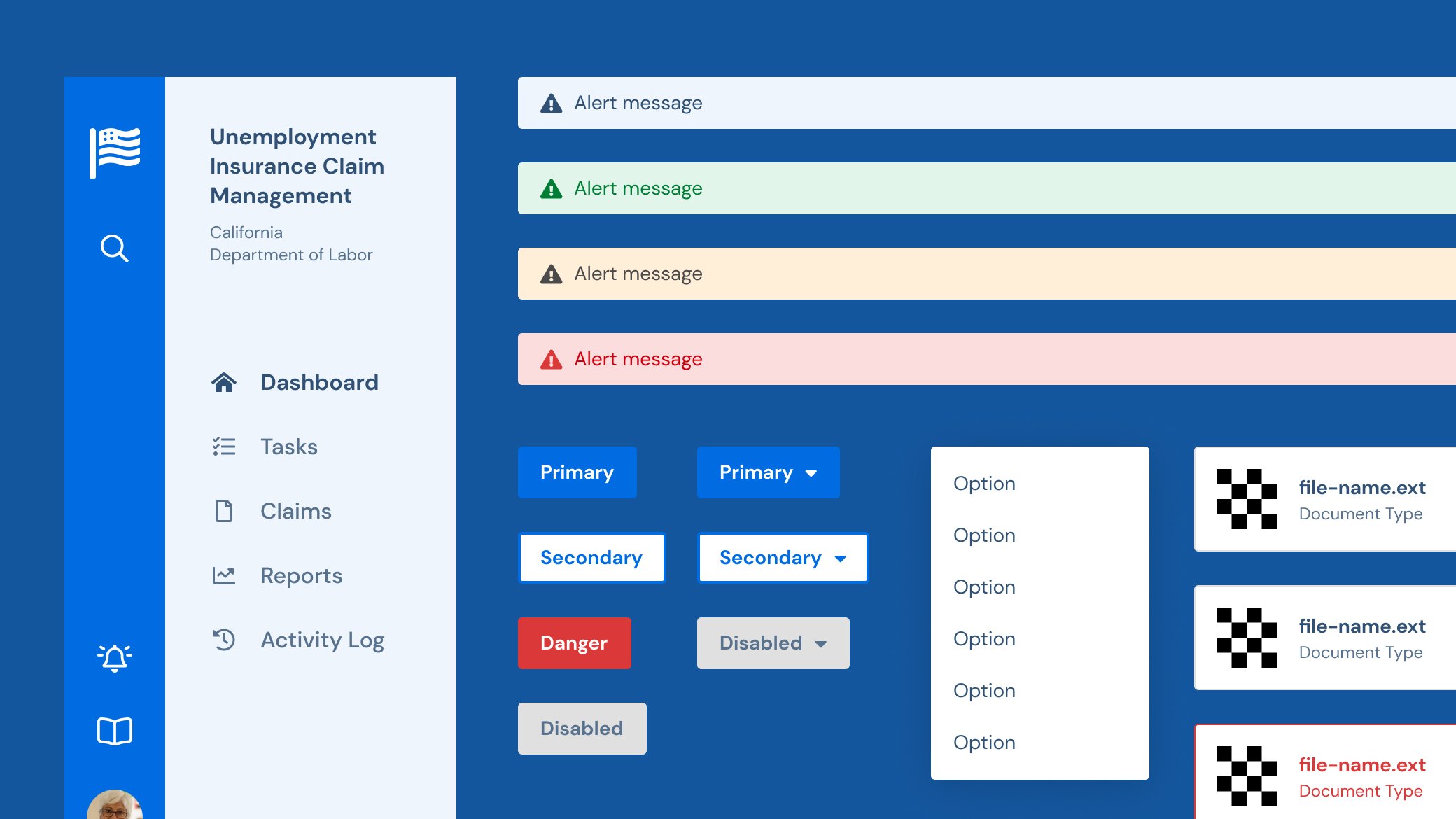

Once the most important problems were identified and prioritized, I designed the claim management application. This prototype was a proof of concept that would show government stakeholders and decision-makers the potential of investing in dedicated researchers, designers, and engineers to improve their claim management systems.

Key features

Dashboard snapshot

Display of assigned tasks, and the number of open tasks and claims to gauge progress.

Guided tasks

Standardized workflows and clear actions to take.

Automated workflow

Accurate, fast identity verification and fraud detection.

Searchable claims

Organized, searchable, and filterable claims.